Tufts University

Class of 1969

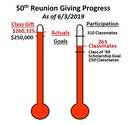

50th Reunion Giving

|

CLASS GIVING CHALLENGES AND PROGRESS at 6/3/19 THANK YOU ALL WHO HAVE DONATED! We met the 250 Donor and $250,000 Class Gift Challenges Only 48 new donors needed by June 30 to set new % giving record |

|||

|

Category |

Description |

Goal |

Status at 6/3/19 |

|

Participation in class of 1969 50th reunion gift goal |

Made a donation or pledge OF ANY AMOUNT between 7/1/18 and 6/30/19 |

311 classmates |

263 classmates (48 to go) |

|

Special challenge for a Class of 1969 Scholarship |

MATCHING GIFT - A generous donor will fund a Class of 1969 Scholarship for one year for a deserving student next fall, if we reach this goal. |

250 classmates |

263 classmates (TADA!) |

|

Total given to the Tufts Fund in our 50th reunion year (July 1-June 30) |

Total of cash gifts, multi-year pledges, and estate planning commitments |

$250,000 |

$260,325 (TADA!) |

|

Other Fundraising Milestones |

Total Giving Since our 45th Reunion |

N/A |

$2,937,649 |

|

Packard Society – donation(s) of $1000 or more to the Tufts Fund (current year, July - June) |

50 classmates |

55! WE BEAT IT! |

|

|

Charles Tufts Society - Classmate has included Tufts in estate plan – cash and/or non-cash assets |

30 classmates |

23 (ONLY 7 to go)

|

|

Scroll down for How to Give

|

HOW TO GIVE – See also Tufts Guide to Giving |

|

|

Check |

Send a check with note that it is a donation for Class of 1969. Include any designation, as for a particular school, scholarships, etc. |

|

Credit card |

Click on MAKE A GIFT |

|

From IRA – tax free to count toward RMD |

How to Make a Charitable IRA Rollover Gift – gift through retirement funds. An Excellent Tax Benefit: This withdrawal counts toward your Required Minimum Distribution (RMD) and effectively reduces your Adjusted Gross Income.

|

|

Planned Gifts |

See Gift Planning or contact Tufts Gift Planning Office (888-748-8387, Fax: 617-627-4541, or emailing giftplanning@tufts.edu). By making a planned gift, you become a member of the Charles Tufts Society and are invited to the annual luncheon at Gifford House. |